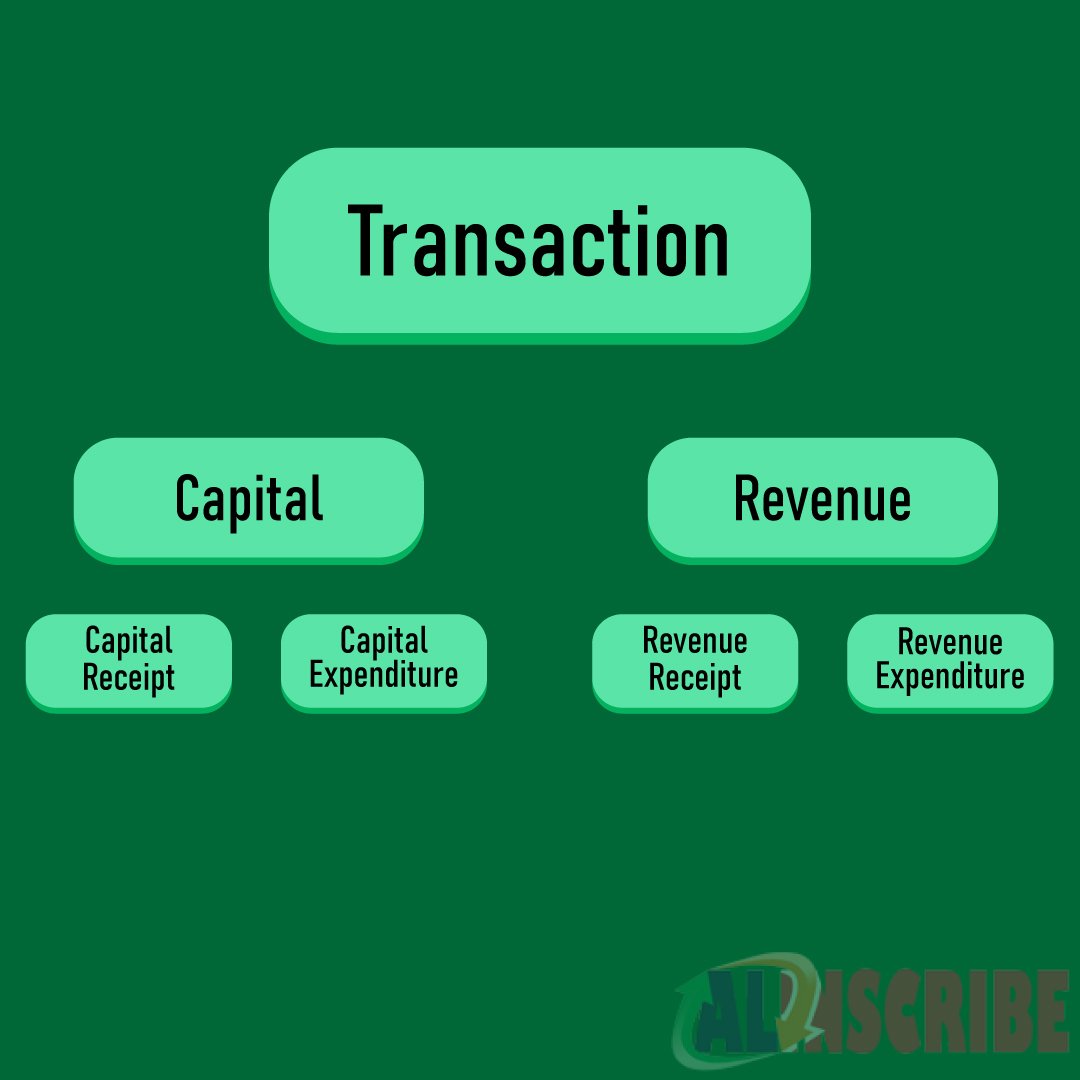

Types Or Classification Of Transactions

Every transaction that a company enters into can be any of the two types i.e,

- Revenue nature

- Capital nature.

Revenue nature transactions:

These transactions are the transactions that occur in the ordinary course of business and frequently occur.

Revenue transactions are the transactions that are expensed or charged to Profit and loss account in the same year it is expended. Revenue nature transactions are expected to help benefits flow into the entity for a short period of time. An expense is classified into Revenue and Capital not by the amount involved but by the nature of cash flows or benefits that accrue to the entity over a period of time. Though the transaction involves huge expense to the entity, it could be revenue nature and on the contrary, transactions involving minimum cost could also be capital nature transactions. Revenue nature transactions are directly recorded into Trading account, Profit and loss account, but doesn’t enter into the Balance sheet directly. These revenue expenses are the short term expenses made to meet the ongoing and operational needs of the entity. Revenue expenses are allowed as a deduction from cash in the year it was incurred. This doesn’t mean that the revenue expenses made don’t increase the profit earning capability of an enterprise. These revenue expenses will have an effect on the profitability of the company, but only to a temporary period generally over a year.

Examples of Revenue nature transactions,

Sale of goods,

Purchase of raw materials,

Ordinary expenses of running the business like electricity charges, rent, salaries, etc.

The entry made for revenue expenses is

Revenue expense a/c -----Debit ( Reflected in Income statement or Profit and Loss account)

To Cash or Payables. ---- Credit

Examples of Revenue nature transactions are,

Revenue from sale of goods,

Commission or discount received on purchase of goods,

Rent and dividend received etc.

The entry made for Revenue receipts is,

Cash or Receivables a/c ----- Debit

To Revenue receipt ------ Credit ( Reflected in Income statement or Profit and Loss account)

Capital nature transactions:

A transaction is treated as capital nature transaction if it is proved that the expense so made can accrue benefits to the entity that pertains for more than a financial year. In other words, these capital nature transactions once expended accrue benefits to the entity for more than one year and are subject to reduction in its value either by usage or depreciation. The capital account transactions have an effect on the value of the assets and liabilities that are reflected in the Balance sheet of a company. In case of transactions related to Fixed assets, a transaction is also considered as a capital nature transaction if the amount so expended can change the useful life of the asset like a technical repair or addition to a machinery used by a company in its manufacturing process that substantially increases the life of the asset. This is the reason the capital nature transactions are deferred or treated as expense over one year. The main aim of a company incurring or spending onto capital expenditure is to expand the company’s revenue generating ability on a long term basis.

Examples of Capital nature transactions:

Capital expenses:

Purchase of Land,

Major additions to Plant and machinery, etc.

The entry for Capital expenses is

Fixed asset (for which the expense is to be capitalized) a/c -----Debit

To Cash or Payables ------ Credit

Capital receipts are the receipts or income accrued to a company that doesn’t occur in the ordinary course of the company and is of Non-Recurring in nature.

Capital income or receipts:

Grant received from the government,

Sale of fixed asset,

Capital introduced by the partner or owner etc.

The entry for Capital receipts is,

Cash or Payables a/c ------Debit

To Capital receipt ------- Credit

Sometimes, though the transaction is of revenue nature, it is to be capitalized i.e it is to be added to the value of the asset as those expenses play a vital role in making the asset ready to use for the intended purpose. Ex: Costs of labour for installation of plant and machinery in the factory premises of the entity, wages paid to the workers for the construction of a building, etc.

Expenses though expended for the capital asset is considered as Revenue expenses as it is made in the ordinary course of business and it doesn’t extend the life of the asset or doesn’t increase the revenue generating ability of the firm. Ex: Repairs to the machinery of the firm.

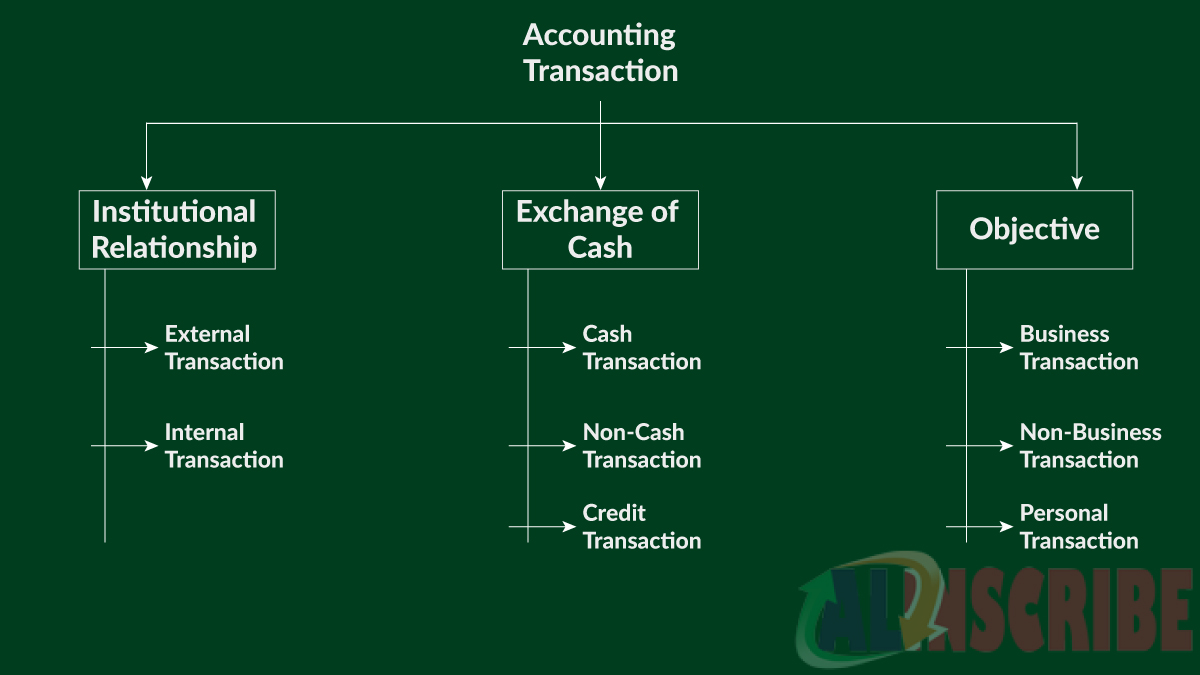

Other classifications of Accounting Transactions

On the other hand, accounting transaction can be classified into three other sub-categories, which are transaction based on institutional relationship, transaction based on exchange of cash and transaction based on objective.

- Internal transaction and external transaction come under institutional relationship.

- Cash, non-cash and credit transaction come under exchange of cash transaction.

- Business transaction, non-business transaction and personal transaction come under objective transactions.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.