Balance Sheet - A detailed article

Balance sheet is the final account which represents the financial position of an entity as on the date of preparing the balance sheet. This statement or account contains the balances of all the accounts after posting of transactions in the respective accounts that are carried forward through trial balance and finally rested in Balance sheet. It is for this reason this account is called Balance sheet as it contains only the balances of the accounts unlike Journal, ledger and other primary books which involves posting of transactions and balancing the accounts. This is the reason the words To and By are not used in this statement. This balance sheet is prepared by taking the balances of Personal and Real accounts along with the net profit or loss obtained in the Profit & Loss account.

Balance is mainly prepared for the following reasons:

- To ascertain the value of assets of the business on a particular day,

- To ascertain the value of liabilities of business on a particular day,

- To ascertain the value of Owner’s equity or to ascertain the proportion of Share holding in the company.

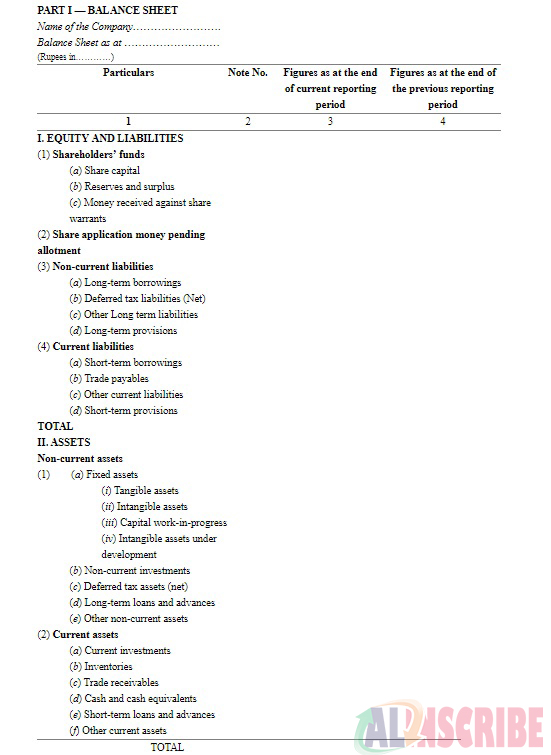

Format of Balance sheet:

With the introduction of Companies act 2013, and Schedule III, the Balance sheet format for Private and Public limited companies is as follows,

The format of Balance sheet for Proprietary concerns and Partnership concerns is as follows,

Items of Balance sheet:

Items of balance sheet are divided into,

- Liabilities and Assets as per Schedule VI format and

- Equity & Liabilities and Assets as per Part I of Schedule III.

Liabilities:

Share capital:

The items under this share capital shall be disclosed with the details like,

- Number of shares authorised along with the amount

- The number of shares issued, subscribed and fully paid, subscribed but not fully paid

- Face value or Par value per share

- A reconciliation of the number of shares outstanding at the beginning and ending of the year or reporting period

- The rights, preferences and restrictions attaching to each class of shares including restrictions on the distribution of dividends and the repayment of capital,

- Shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by or subsidiaries or associates of the holding company or ultimate holding company in the chain of holding.

- Share holding of the individual shareholders if the holding of more than 5% of the total share capital of the company.

- Shares held separately or reserved for issue under options and contracts or commitments for the sale of shares or disinvestment.

- Aggregate value of calls unpaid including a separate disclosure about calls unpaid by the directors and officers of the entity,

- Amount originally paid up on he forfeited shares

Reserves and surplus:

1. Reserves and surplus shall be classified into the following categories,

- Capital reserve,

- Capital redemption reserve (CRR),

- Securities premium reserve,

- Debenture redemption reserve,

- Revaluation reserve,

- Share options outstanding reserve,

- Other reserves if any maintained by the entity,

- Surplus* or P&L.

2. Any reserve specifically held or earmarked for investments,

* Debit balance of Profit and loss account shall be shown as a Negative figure under the head Surplus. The balance of surplus if any, shall be shown under the head Reserves and surplus.

Long term borrowings:

Long term borrowings are classified as ,

- Bonds / debentures,

- Term loan from

- Banks and

- Other parties

- Deferred payment liabilities,

- Deposits,

- Loans and advances from related parties ,

- Long term maturities of finance lease obligations,

- Other loans and advances.

Borrowings shall further be sub classified as secured borrowings and unsecured borrowings and nature of security for secured borrowings shall be specified separately in each case. Where loans have been guaranteed by directors or others, the aggregate value or amount of such loans under each head shall be disclosed. Particulars of any redeemed bonds/debentures which the company has power to re issue shall be disclosed. Terms of repayment of term loans and other loans shall be clearly stated.

Long term liabilities:

Other long term liabilities shall be classified into,

- Trade payables

- Others

Long term provisions:

Provision is an amount kept aside for the purpose of meeting future commitments. They are created by estimating the possibility of future defaults.

The provisions made for long term items shall be categorised under this head and shall be disclosed as following,

- Provision for employee benefits,

- Others.

Short term borrowings:

Borrowings that are borrowed for meeting the short term commitments of the entity is referred to as Short term borrowings.

Short term borrowings shall be classified as,

- Loans payable on demand from banks and other parties to be disclosed separately,

- Loans and advances from related parties,

- Deposits,

- Other loans and advances

Borrowings shall be further classified into Secured and Unsecured based on whether any security is provided on the borrowings borrowed. The nature of security if provided shall also be stated. Where loans have been guaranteed by directors or others, the aggregate value or amount of such loans under each head shall be disclosed. Period of default as on the balance sheet date in repayment of loans and interest shall be specified separately in each case.

Trade payables:

For Micro, Small and Medium enterprises, the following shall be disclosed in the notes,

- The principal amount and the interest due thereon remaining unpaid to any supplier at the end of each accounting year,

- The amount of interest paid by the buyer in terms of section 16 of the Micro, Small and Medium enterprises development act 2006 along with the amount of the payment made to supplier beyond the appointed day during each accounting year.

- The amount of u retest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under the Micro, small and medium enterprises development act 2006.

- The amount of interest accrued and remaining unpaid at the end of each accounting year and

- The amount of further interest remaining due and payable even in the succeeding years until such date when the interest dues above are actually paid to the small enterprise for the purpose of disallowance of a deductible expense under Section 23 of Micro, Small and Medium enterprises development act 2006.

Other current liabilities:

The amount of liabilities shall be classified as,

- Current maturities of long term debt,

- Current maturities of finance lease obligations,

- Interest accrued but not due on borrowings,

- Interest accrued and due on borrowings,

- Income received in advance,

- Unpaid dividends,

- Application money received for allotment of securities and due for refund and interest accrued thereon shall be disclosed.

- Unpaid matured deposits and interest accrued thereon,

- Other payables

Short term Provisions:

The amounts under these shall be classified as,

- Provision for employee benefits and

- Others.

Assets:

Tangible Assets:

i. Classification for Tangible assets is to be shown as,

- Land,

- Buildings,

- Plant and Equipment,

- Furniture and fixtures,

- Vehicles,

- Office equipment,

- Others.

ii. Assets that are leased shall be disclosed separately under each class of asset.

iii. A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and at the end of the reporting period shall be disclosed separately.

Intangible Assets:

It shall be classified as,

- Goodwill,

- Brands / trademarks,

- Computer software,

- Copyrights and patents,

- Designs or prototypes,

- Licenses and franchise.

Non – Current Investments:

They shall be classified into Trade investments and other investments.

i. They shall be further classified into,

- Investment in property,

- Investment in Equity instruments,

- Investment in Preference shares,

- Investment in Government or trust securities,

- Investment in debentures and bonds,

- Investments in Mutual funds,

- Investments in partnership firms,

- Other non – current investments

ii. Investments carried at other than cost should be separately stated and the basis for its valuation shall also be disclosed,

iii. The following shall also be disclosed,

- Aggregate amount of Quoted investments and Market value thereof,

- Aggregate amount of Unquoted investments,

- Aggregate provision for diminution in value of investments.

Long term loans and advances:

- Long term loans and advances shall be classified as,

- Capital advances,

- Security deposits,

- Loans and advances to related parties,

- Other loans and advances,

- The above shall also be separately sub classified as:

- Secured, Considered good,

- Unsecured, Considered good,

- Doubtful.

- Allowance for bad and doubtful loans and advances shall be disclosed under the relevant heads separately,

- Loans and advances due by directors or other officers of the company or any of them either severally or jointly with any other persons or amounts due by firms or private companies respectively in which any director is a partner or a director or member should be separately stated.

Other Non-Current assets:

They shall be classified as:

- Long term trade receivables,

- Others,

- Long term trade receivables, shall be sub-classified as,

- Secured, Considered good,

- Unsecured, Considered good,

- Doubtful.

- Allowance for bad and doubtful debts shall be disclosed under the relevant heads separately.

Current Investments:

- Investment in Equity instruments,

- Investment in Preference shares,

- Investment in Government or trust securities,

- Investment in debentures and bonds,

- Investments in Mutual funds,

- Investments in partnership firms,

- Other current investments.

Inventories:

Inventories shall be classified as,

- Raw materials,

- Work in progress,

- Finished goods,

- Stock-in-trade,

- Stores and Spares,

- Loose tools, Goods in transit shall be disclosed under the relevant sub head of inventories.

Trade receivables:

- Aggregate amount of Trade receivables outstanding for a period exceeding six months from t date they are due for payment shall be separately stated.

- The trade receivables shall be classified as,

- Secured, Considered good,

- Unsecured, Considered good,

- Doubtful

- Allowance for bad and doubtful debts shall be disclosed under the relevant heads separately.

- Debts due by directors or other officers shall be disclosed separately.

Cash and Cash equivalents:

- Cash and cash equivalents shall be classified as,

- Balances with banks,

- Cheques, drafts on hand,

- Cash on hand,

- Others

- Earmarked balances with banks shall be separately stated,

- Balances with banks to the extent held as margin money or security against the borrowings, guarantees, other commitments shall be disclosed separately.

- Bank deposits with more than 12 months maturity shall be disclosed.

Short term Loans and advances:

- Short term loans and advances shall be classified as,

- Loans and advances to related parties,

- Others.

- The above shall be classified as,

- Secured, Considered good,

- Unsecured, Considered good,

- Doubtful

- Allowance for bad and doubtful loans and advances shall be disclosed under the relevant heads separately.

- Loans and advances due by directors or other officers shall also be separately stated.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.