Approaches To Accounting And Golden Rules Of Accounting

There are various approaches which are used for the formulation of accounting process. Under double entry book keeping system, transaction with invoices or proper documents acting as evidence to them are analysed in terms of money and are recorded in the books of accounts. Two approaches are followed for the purpose of analysing dual aspect of such transaction namely

- Accounting Equity Approach

- Traditional Approach

ACCOUNTING EQUITY APPROACH

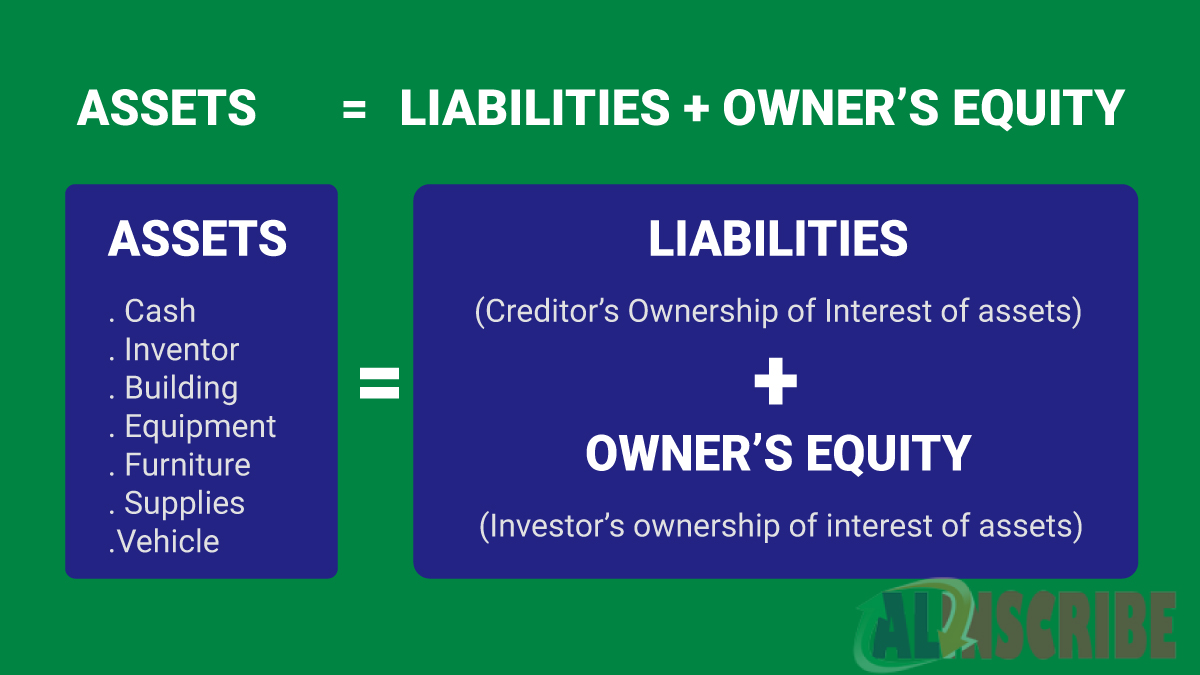

This approach is also called American approach or Modern approach. Balance sheet which is one of the essential elements of financial statements follows the accounting equity approach. The basis of equity approach lies in the double entry book keeping system. It gives the relationship between assets, liabilities and equity.

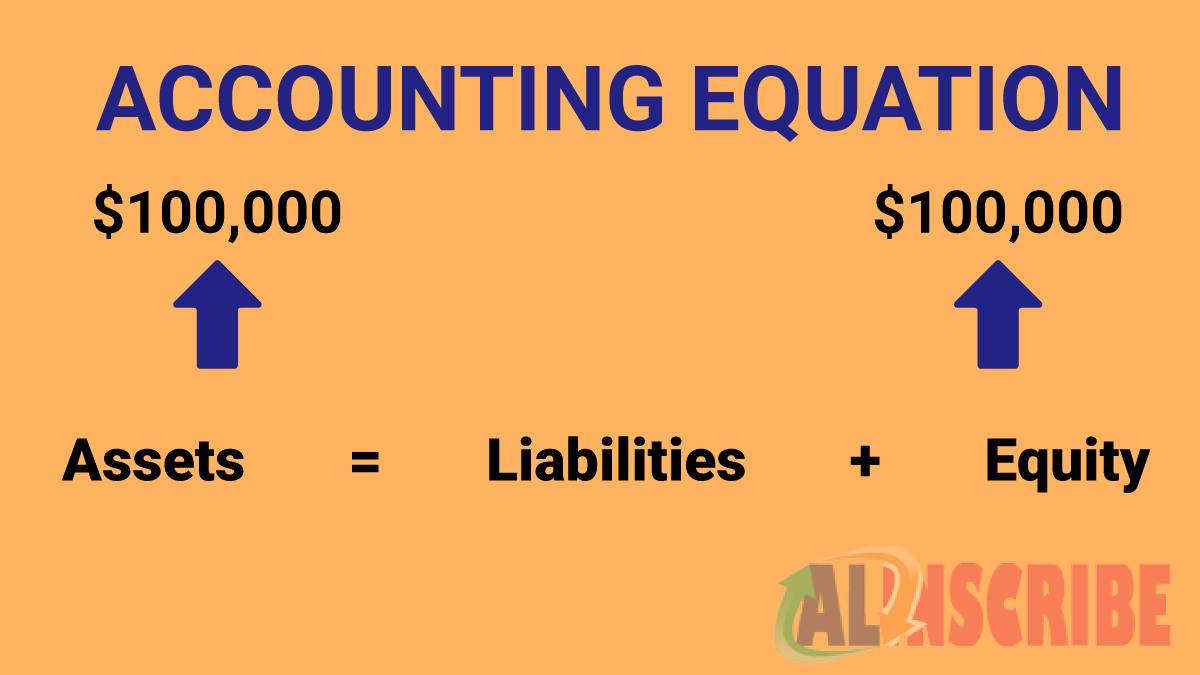

Accounting equation gives the relation of assets with liabilities and equity (shareholder’s fund). Because of the two fold effect of each transaction, the balance between assets and sum total of equity and liability, are equalized both the sides of balance sheet. Accounting equations are always completed and equated as each transaction will always affect equity, liability or assets ensuring there is always a twofold effect.

If expressed as an equation:

Total Assets = Equity Fund+Liability

To explain the equation, if the owner has introduced a capital of one lakh in cash

Equity fund + liability = total assets

1, 00,000 + 0 = 1, 00,000 (Here, on the liabilities side, the amount of Rs.1,00,000 introduced as capital is shown as equity or capital fund making the total of liabilities side to Rs.1,00,000).

Introduced as capital +0 = asset in form of cash (Here, since the amount is introduced in the form of cash, it resided in the business either in form of cash or balance in the bank on the assets side of the balance sheet. This makes the total of the assets side Rs.1,00,000).

If the above transaction is the only transaction of a business in the year and no other transaction has been made, then the sum total of Assets and Liabilities is Rs.1,00,000 and it is equalized even without making any adjustments.

Lets understand the aspect with few more transactions,

Purchasing of an fixed asset worth one lakh in credit (i.e not for cash) (long term liability existing for more than three years)

Equity fund + liability = total assets

0 +1, 00,000 = 1,00,000

0 + exist as loan in long term liability = fixed asset in asset side

(Here, on the liabilities side, the amount of Rs.1,00,000 is shown as long term liability and the same Rs.1,00,000 is shown as the value of asset purchased on the asset side).

TRADITIONAL APPROACH

This approach is also called as British Approach or Conventional Approach. It involves two aspects of every transaction namely, debit and credit. These Debit and Credit governs all the transactions and each phase of its recording. Debit and Credit and the dual aspect is explained below in detail:

- When there is an addition in value of an asset due to any reason, the asset account is debited and if it is a reduction in the value of the Asset, the respective asset account will be credited which results in a deduction of the total value of asset in the entity.

- When there is a decrease in the total amount of liability, liability account (ex: creditors) will be debited and if it's an increase, the account will be credited.

(By the above two points it is understood that an Asset will always have Debit balance and to increase its value, we have to debit it and vice versa. A liability account will have Credit balance and to increase i ts value, we have to credit it and vice versa).

- Owner's fund transactions are adjusted to capital account. If there is an introduction of capital or increase of capital the account will be credited with the amount of addition (Since, capital is seen as a liability in view of company and the company has to repay it to the proprietor or the shareholders on a future date). In case of withdrawal or reduction of capital, the account is to be debited.

- Profit is the return which the owner will get back from the business for the investment he makes in the business which is in form of capital. Profit earned from the business will be added to the capital ( as the profit earned is again invested in the business hence increasing the amount infused into the business) and a loss to reduce the capital (as the loss suffered by the entity has eroded the capital infused by the owner).

- Income is always credited and expense will be debited as expense is treated as the amount already incurred by the entity for any benefit that has flowed into or may flow into the business in future and income is treated as the income earned by entity and is liable to be spent again or returned back to the owner or infused into the entity.

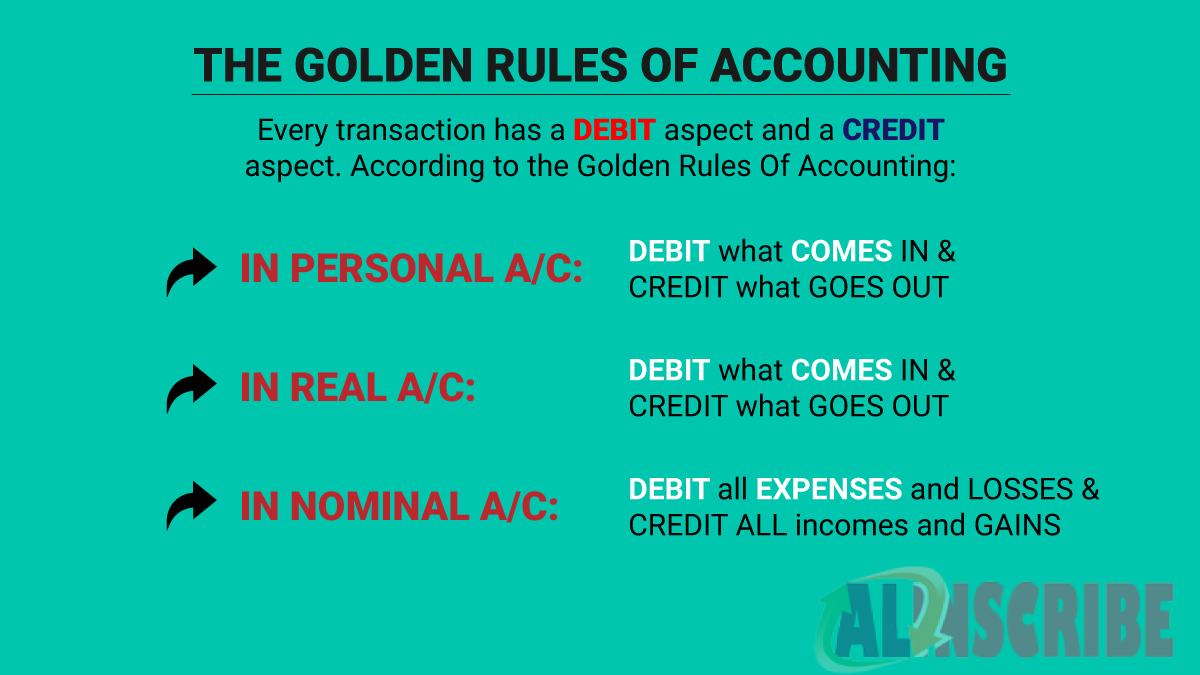

To decide every transaction’s debit and credit, the Golden Rules of Accounting are followed.

GOLDEN RULES OF ACCOUNTING

All the transaction are resulting into one Debit and one Credit. While journalizing and posting the transaction into various ledger accounts, there will be one debit and one credit

For recording the transactions GOLDEN RULES OF ACCOUNTING, are applied under Double entry system.

1. Personal account is governed by the following two rules:

“Debit the receiver

Credit the giver”

Personal account can be considered as a general ledger that is associated either with an individual or an organization. The explanation of this rule is simple, if you receive something then debit the account and if you give something then credit the account.

2. Real account is governed by the following two rules:

“Debit what comes in

Credit what goes out”

Real accounts or permanent accounts are the accounts that do not close at the year-end. These accounts can be of various kinds such as liability account, asset account, or equity account. In such cases when something comes to your business then debit the account. And when something goes out of your business then credit the account.

3. Nominal account is governed by the following two rules:

“Debit all expenses and losses

Credit all incomes and gains.”

This rule is associated with the temporary accounts, also known as the nominal accounts. In the case of nominal accounts, you need to debit the account when your business faces an expense or a loss. On the other hand, you need to credit the account when you business experience an income or gain.

Summary of the discussion is as follows

- In case of asset, increase of the value will be debited and decrease will be credited

- In case of liability, increase will credited and decrease will be debited.

- Increase in expenses will debited and decrease in expense will credited.

- If it is revenue or income, an increase in income should be credited and decrease will debited in their respective accounts.

- Increase in owner's fund or capital will be credited and decrease will be debited.

Using the above rules, all the transactions are recorded and journalized. The process of journalizing is based only on debit and credit rules

For this purpose, all the transactions are classified into three categories namely,

(i) Transactions relating to Individual or artificial persons – Personal account nature transactions.

(ii) Transactions related to assets and properties – Real Account nature transactions.

(iii) Transactions related to expenses, losses, income and gains – Nominal account nature transactions.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.