Generating Financial Information And Users Of Financial Information

Businesses need to make informed and data-driven decisions to keep gaining success in this competitive world. Especially when it comes to making financial decisions, ensuring that your decisions are well-informed is a crucial step.

However, generating financial information is not as easy as it seems. It needs to be performed maintaining a specific methodology. The steps of generating financial information are presented below:

Generating financial information involves the following steps:-

Identifying:

This is the first stage or step in generating the financial information. It involves identifying and capturing the financial data from the source documents like vouchers or bills.

Recording:

This is the next step in generating the financial information which involves maintaining a systematic recording of business transactions, which are identified in an orderly manner.

This Recording of transactions is done in a book called “Journal”. This is the major function through which the transactions are entered into the books of the entity.

Classifying:

Classification is the next step which involves the analysis of the data earlier recorded with an intention to classify or group the transactions of similar nature together in a meaningful and usable way like in Ledgers etc. This data is further processed in different steps and finally takes its route into the financial statements.

Summarizing:

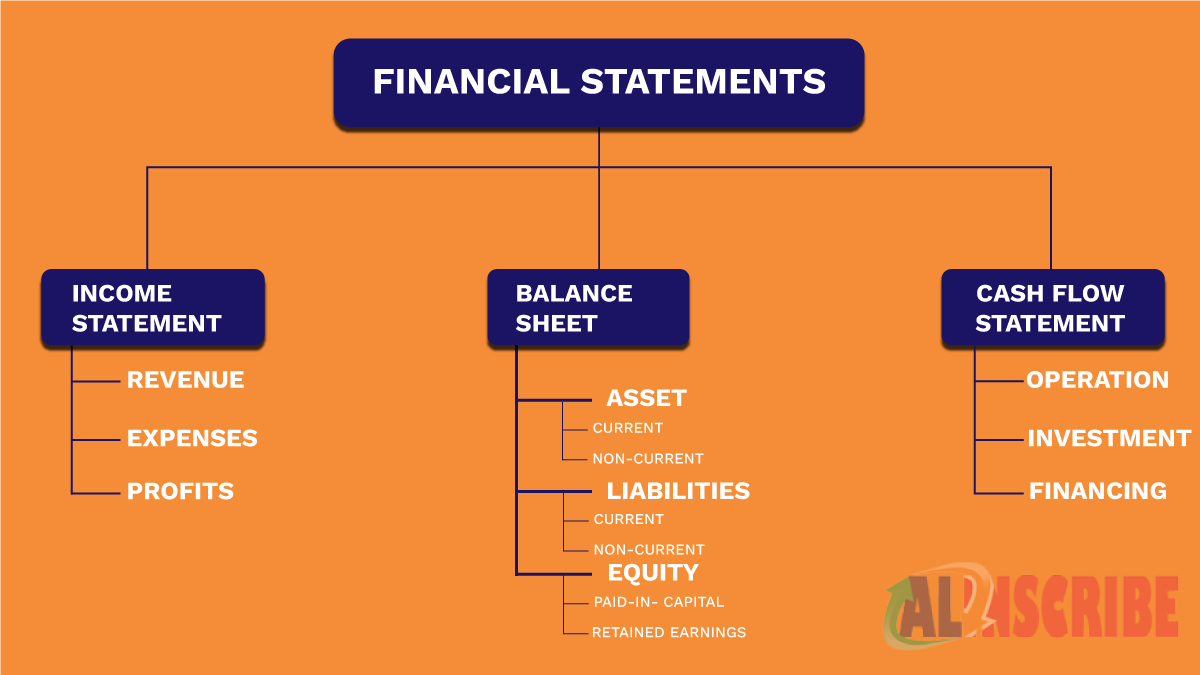

This step is concerned with the presentation of the classified data for the uses of management in form of profit and loss account or income and expenditure account etc.

These summarizing alters or affects the accounts of the party and the entity’s own. This step involves preparation of following:

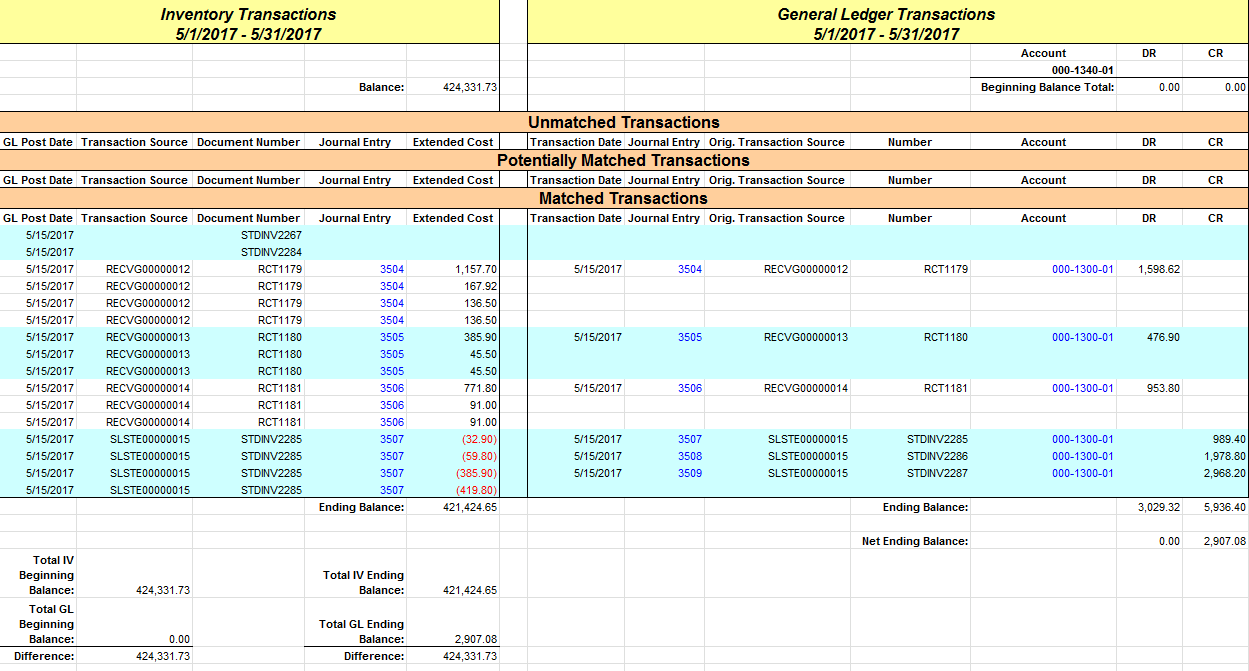

- Trial Balance

- Profit & Loss account or Income and expenditure account

- Balance sheet

- Cash flow statement

Analyzing:

Analyzing involves establishing the relationship with the items of profit and loss account and the items of balance sheet. The main intention behind this analysis is to identify the financial strength of the business. It lays down the step for interpretation.

Interpreting:

This step deals with explaining the meaning and significance of the transactions those occurred and the relationship of them in the final accounts of the company. This interpretation acts as a basis for the users of financial statements to take decisions. This interpreted data explains the position or financial strength or solvency and profitability of the entity. This data should explain the results of the transactions the business had entered with and the possible outcomes in the near future.

Communicating:

This deals with the transmission of the results of the above steps like summarizing, analyzing, interpretation in a meaningful manner to the interested parties or the users of financial information to enable them in decision making. This communication is done in the form of reports like graphs, charts etc in addition to the regular financial statements.

Uses and Users of Financial Information

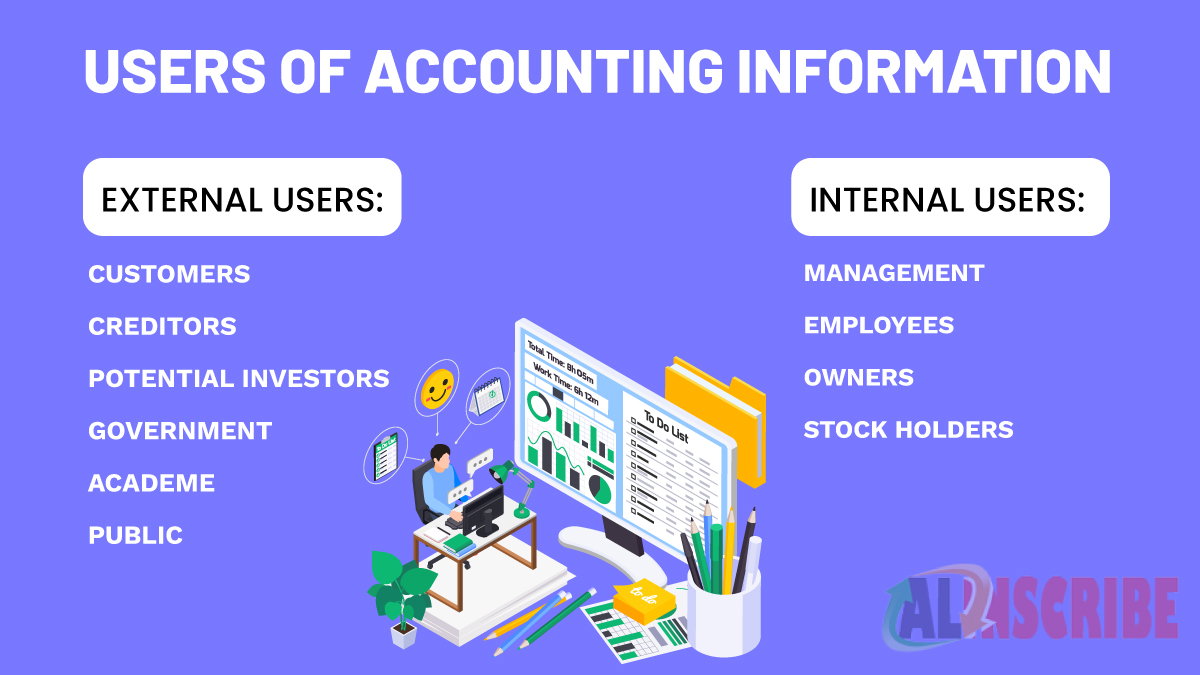

The importance of financial information of an entity doesn’t last just till the entity is in existence; it also is useful after its liquidation or winding up. As earlier, the financial information was useful for owner or proprietor only. But now, the financial information is useful for large group of people like investors, employees, lenders, suppliers, customers, government, tax authorities.

Broadly, the users of financial information is divided into two parts.

- Internal users

- External users

Uses of financial information:

Financial information, though seems to contain numerical data, it provides vast details of the business and its operations, its sources of funds etc. The unbiased financial information helps the users in decision making. Financial information of an entity for a particular year does not only describe the situation of an entity for a particular year but also for previous years. Financial information is used for various purposes like:

Performance management:

It is used for the purpose of measuring the performance of the entity through the various business operations. Financial information including the financial statements acts as yardstick in measuring or comparing the performance of the entity. It could be used to compare the entity’s performance with its own performance in the past or even with the other entities in the industry and to set the standards for future growth.

Budgeting decisions:

Financial information helps the entity in creating and planning the budget forecasts for various projects and effective utilisation of the resources there by increasing the profitability of the company and the returns for the investors.

Business decisions:

Business decisions involve the decisions relating to expansion of the business through mergers or acquisitions or through diversification into other fields or new products. The financial information helps the managers to make a cost benefit analysis estimating and comparing the return and the investment they make.

Investment decisions:

Investment decisions involve decisions like whether or not to lend (or) whether or not to invest, taken by the external financial sources like share holders or banks or financial institutions. Capital is the main hurdle to many small businesses and entrepreneurs to develop their businesses and to raise the capital, not every business can go for public issue of shares. So these small businesses borrow funds through banks and other financial institutions which rely solely on the financial information or the financial statements of the business.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.