Cash Flow Statement

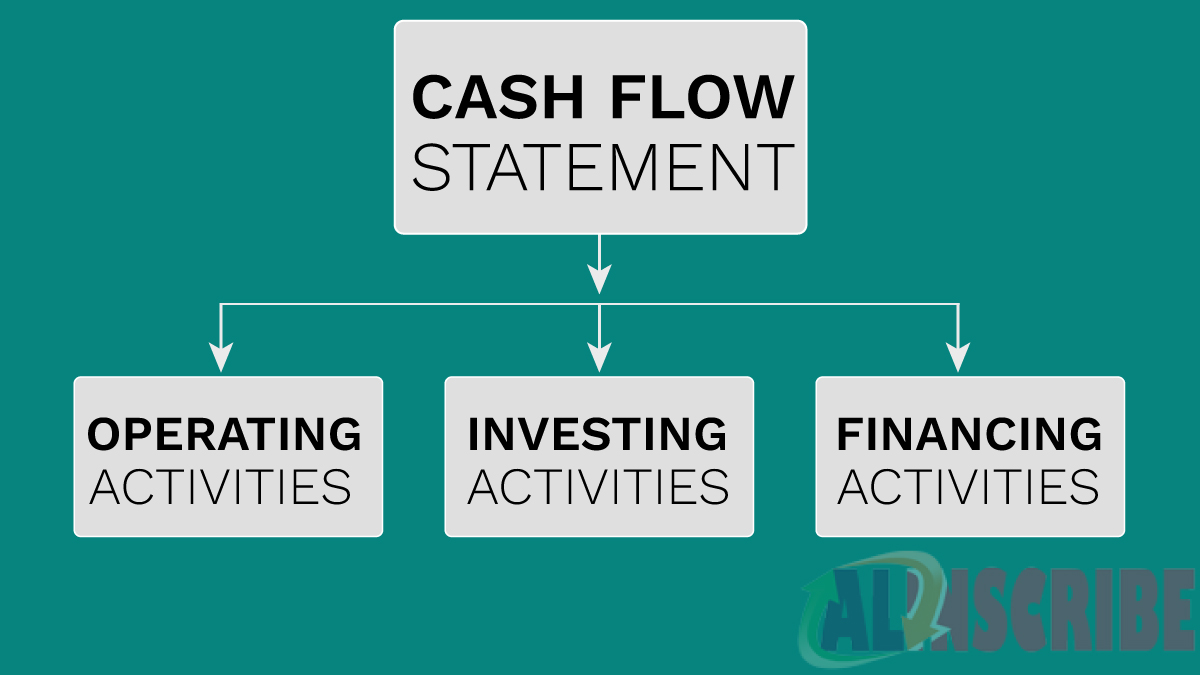

Cash flow statement is one of the elements of Financial statement which describes the flow of cash through the business. It shows the inflow and outflow of cash happening in business. It is an activity-based statement that particularly focuses on activities such as financing activity, investing activity and operating activity that uses cash. To determine the short term viability of the entity, Cash Flow Statement is an analytical tool which is used.

There are many users other than the management or the proprietor who are interested in reading Cash Flow Statement and this statement also affects their decision. These people are as follows,

- Shareholders

- Employees or contractors

- Investors

- Lenders or creditors

Cash Flow Statement reflects the liquidity of the firm. It was called as Flow of Fund Statement previously. Cash Flow Statement is considered less important or normal, but it could be used to learn the trend in performance of business to a greater extent and it also explains the strategies of the management and efficiency they put forth in managing the funds of the enterprise. If there is divergence between the amount of net cash flow generated by operation and the amount of reported profit, Cash Flow Statement will be needed to identify the divergence to an extent.

The reasons for the difference between the income statement results and Cash Flow Statement are as follows -

- The aggressive use of revenue recognition by management.

- If the business focuses more on assets, it will make more investment in capital and assets which doesn’t appear in income statement.

- Timing difference between the actual expenditure or receiving with the time of recording those.

As said earlier, all the activities the entity has entered into is divided into three categories as follows and it is done so to give an estimate about the expansion strategy of the entity as well as to have a track of activities and proportion of spending done in each category.

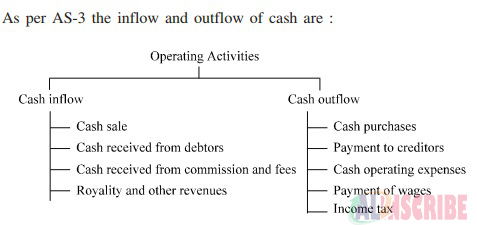

Accounting Standard 3 discusses about the Cash flow statement and it categorizes the activities as follows,

Different types of activities in cash flow statement

Operating activity

Defines or contains the revenue generating activity of a business. It mainly deals with core operating for business of the entity. Purchase, sales, incentives, expenses etc are all falling under the head of operating activity. Generally major part of profit and loss items fall under operating activity.

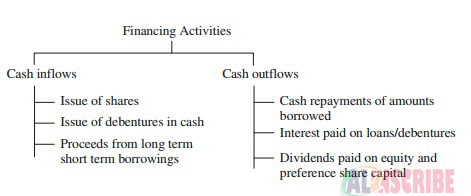

Financing activity

It shows the flow of cash relating to equity as the borrowing of a business.

Examples are Loans (long term and short term), Sale of company shares, Repurchase of shares and dividend payment.

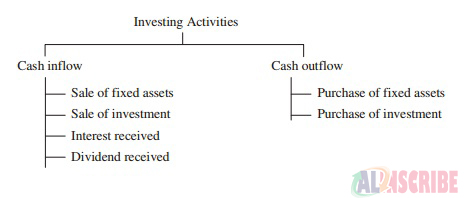

Investing activity

The payment made to purchase or acquire long term asset and inflow of cash while selling it falls under financing activity. The purchase or sale of securities of other entity is also under the purview of investing activity.

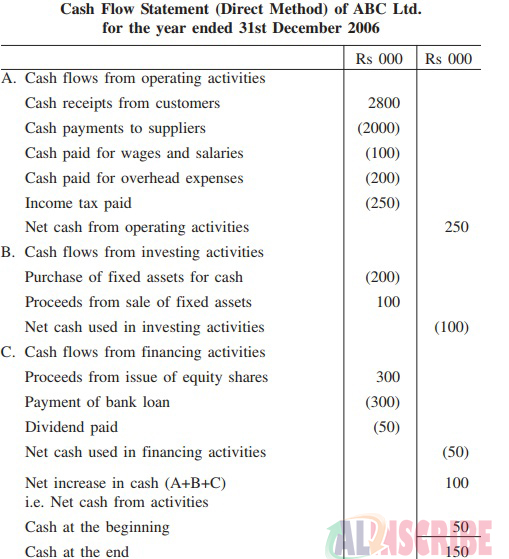

As for Cash Flow Statement methods, there are two methods of preparing Cash Flow Statement:

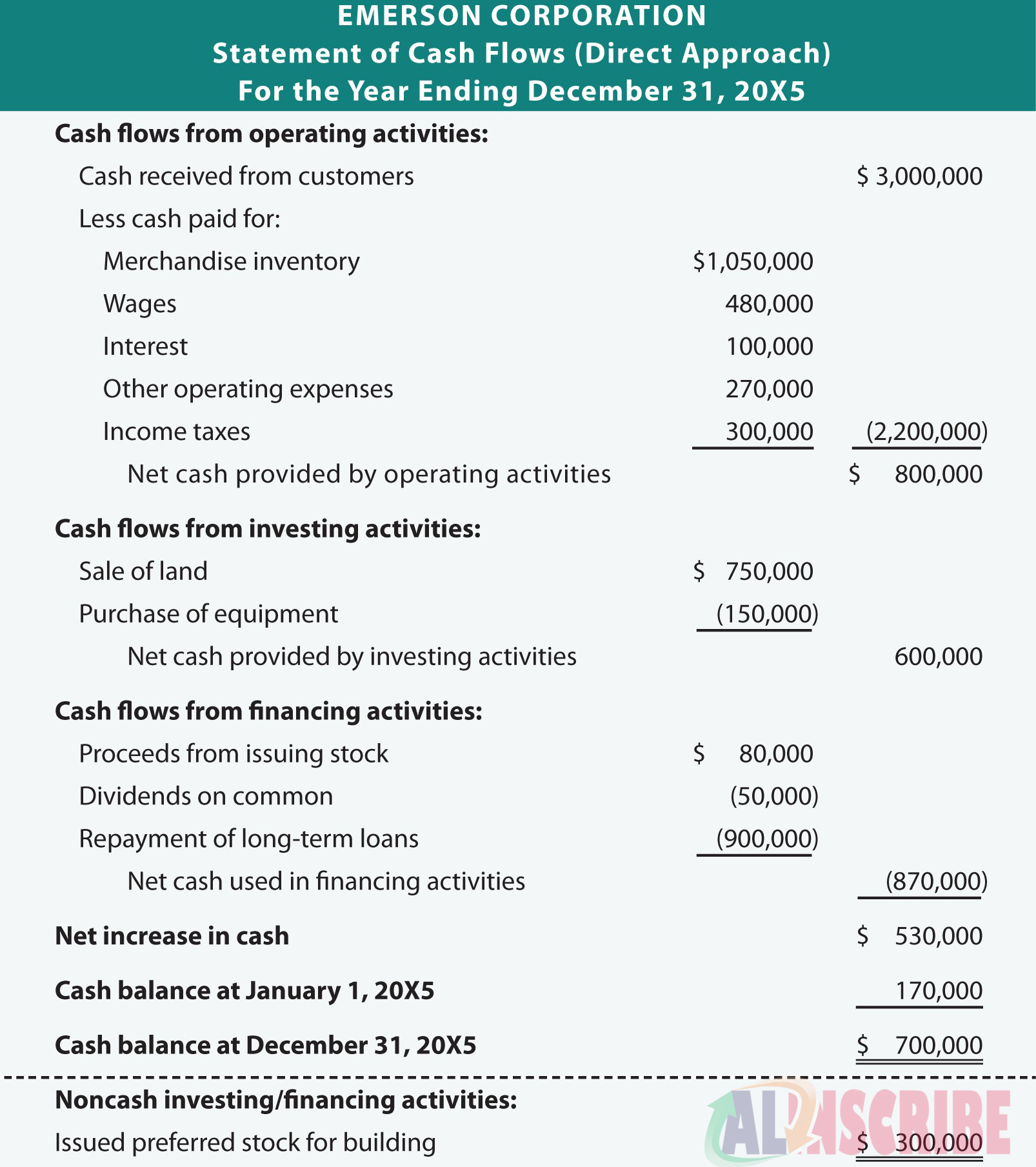

Direct Method

Cash Flow Statement prepared under direct method is easy to read and understand as it lists out all the major operating cash receipts and payments during the period by source. The list of most common types of receipts and payments used in direct method format are as follows.

- Interest payments

- Payments to employees

- Payments to suppliers

- Receipt from customers

As we are listing these payments, the users of the financial statements are provided with more information about the source of the receipts and the purpose of utilizing the payments. Limitation of direct method cash flow statement is that it is most difficult and time consuming to prepare.

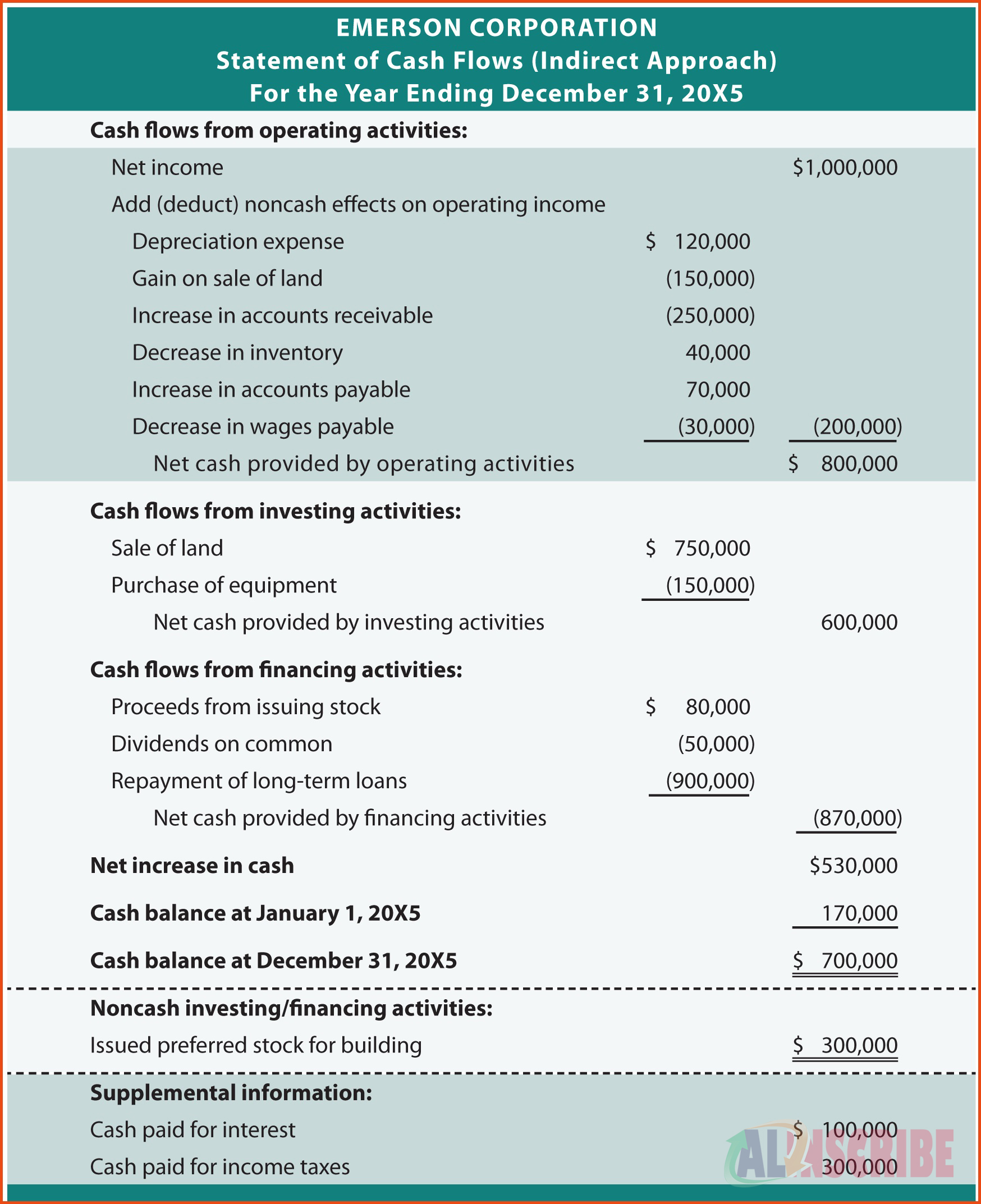

Indirect method

Indirect method of cash flow statement starts with net income while adjusting from all cash based transaction. It adjusts net income rather than individual items being adjusted. This method by process of additions deduction converts accrual basis net income or loss into cash flow.

Direct v/s indirect – Comparison between Direct and Indirect method

A firm reports reports the following details

- Revenue of 2,50,000.

- The accounts receivables increased by 72,000

- Cash collected from receivables is 1,78,000.

- Operating expenses was 1,10,000.

- Accounts payable increased by 10,000.

Direct method

Net cash flow from operating activity

Cash flow from revenue ( 2, 50, 000 - 72, 000 ) 1, 78, 000

Cash flow from expenses ( 1, 70, 000 - 10, 000 ) ( 1, 60, 000)

Net cash flow 18, 000

Indirect method

Net cash flow from operating activity

Revenue from operations 2, 50, 000

Expenses 1, 70, 000

Net income 80, 000

From the amount of 80,000, there is an increase in account receivable by an amount of 72,000 and so it has to be deducted and an amount of 10,000 is to added back on account of increase in accounts payable. This will end up again at the amount of 18,000 as net cash from operating activity.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.