Investment Banking And Its Functions

An Investment bank is an entity that raises capital for companies. In order to raise capital for the companies, these Investment banks sell securities to public investors. Securities may be in the form of stocks or bonds. Investment Banking is a broader term that covers under its scope the activities like Underwriting, Selling and trading securities, providing financial advisory services, IPO advisory and managing assets, divestitures, private equity syndication, advising on mergers and acquisitions, restructuring to increase the efficiency and maximization of profit. In brief, Investment banks are the financial intermediaries that assist the client in raising capital either by being an agent in issue of securities or by underwriting the bonds or stocks. Investment bank doesn’t hold any inventory of cash deposit. Large players involve in all the typical activities concerned with Investment banking, small players focus only on investment banking and sales or trading or research.

Some of the big Investment banking players in the market are J.P.Morgan & co., Goldman Sachs, Bank of America Merrill lynch, Citi group, Barclays Investment bank, Credit Sussie, Deutsche Bank, Wells Fargo Securities, RBC Capital markets.

The Organizational Structure of an Investment bank includes,

Front office, Middle office and back office.

Front Office:

Front office activities are Revenue generating activities which are from the areas of Investment banking and Markets (Sales & trading, Research).

Corporate Finance:

Corporate finance generally includes “Mergers & Acquisitions (M&A) advisory” & “Underwriting”.

M&A advisory functions include providing assistance in negotiating and structuring merger between two companies, co-ordinating with bidders. These advisory functions include buy-side and sell-side advice after appointing buy-side and sell side analysts by the Investment bank. The bank normally arranges the deal after issuing or generating “Pitch book” (A Pitch book is a presentation that consists analysis of investment considerations of client to secure or acquire a M&A deal) to the M&A client and M&A client accepts it. This division of Investment banking & advisory is split into Industry coverage and Product coverage groups. These groups focus on either specific industry like Food & Beverage, Corporate defense, Healthcare etc or financial products such as mergers and acquisitions, leveraged finance, asset leasing etc as the name suggests.

Sales:

Sales are another important or core function of an Investment bank. The primary responsibility of an investment bank is to call high net worth individuals and institutions to suggest trading ideas based on “Caveat Emptor” basis. The sales people take the form of The Classic Retail broker or Institutional Salesperson or Private client Service Representative.

The Classic retail brokers develop relationships with individual investors and sell stock and stock advice to them.

Institutional sales person develop business relationships with large institutional investors who manage large groups of assets.

Private Client service people act like both retail brokers and Institutional sales person providing brokerage and money management services for wealthy individuals.

Trading:

Trading is also a vital activity performed by the bank. The sales people communicate or transfer the client’s orders to the trading people. These trading people then facilitate and execute buying and selling of stock or other securities based on the need of the client. The traders sell the securities they bought at a slightly higher price which leads to Bid-ask Spread (price difference between Purchase price and sale price). This Spread is the income of traders.

Sales and trading could also engage in proprietary trading. Proprietary trading involves special group of traders who do not work with clients. These traders take on Principal Risk, which involves buying and selling a product and these people doesn’t hedge their total exposure.

Research:

The Securities Research division analysts study stock and bonds and make prepares reports and makes recommendations with the tag “Buy” , “Sell” or “Hold”. These people are also called “Equity analysts”. These analysts focus on specific industry and may cover upto 20 companies a given point of time. The research division doesn’t fetch any income directly, but the analysis they made and the reports they make help the sales person and advisory managers to suggest ideas to customers thereby earning revenue to the entity.

There exists a conflict of interest between the research and other parts of the investment bank, which means that the analysis of the research team would influence the relationship of the bank and client. For example, if the proprietary trading division wanted to boost the return on their holdings, they could have research analysts recommend some of the stock they held as a buy. There are a number of areas where the research department could be used to mislead investors and earn more profit for the investment bank.

Regulators insist “Chinese wall” implementation in their firms to curb these misleading activities. The Chinese wall keeps information about the investment bank’s corporate finance and sales and trading activities from passing through to the research department.

A Chinese wall also exists between the corporate finance and sales and trading divisions because many corporate finance activities involve non-public information that could be used to profitably execute trading strategies.

Syndicate:

The syndicate provides a vital link between the sales people and the corporate finance. The main reason of syndicate is to facilitate the placing of securities for public offering. It also means allocation of bonds sometimes.

In investment bank perspective Syndicate refers to a group of investment bankers together for large or risky businesses. A syndicate is a temporary association of investment bankers brought together for the purpose of selling new securities. One investment banker is selected to manage the syndicate called the originating house, which does underwriting of the major amount of the issue. There are two types of underwriting syndicates, divided and undivided. In a divided syndicate, each member group has liability of selling a portion of offerings assigned to them. However, in undivided syndicate, each member group is liable for unsold securities up to the amount of its percentage participation irrespective of the number of securities that group have sold.

Risk Management:

Risk management means analyzing the market and credit risk investment bank or clients agree to take into their financial statements during transactions or trades. Credit risk focuses around activities related to capital markets, restructuring, issuing of bond, leveraged finance.

Middle office:

This middle office is responsible for internal controls, Treasury management and internal corporate strategy.

Treasury management involves Management of capital structure, monitoring of risk of liquidity, sources of funding of Investment bank.

Internal control in general sense means the controls placed in an entity that are responsible for effective, detection of weaknesses and policies laid down to comply with the organizational objectives. In the terms of Investment bank, it includes tracking and analyzing the flow of capital from the firm and into the firm.

Internal corporate strategy means tackling the firm management and profit making strategies is a key role in investment banks.

Back office:

Back office carries out the functions like background checks of the trades, transactions passed through and the transactions not settled etc. Most of the cases, these functions are outsourced by the investment banks.

How is Commercial banking different from Investment banking?

Though the functions of Commercial and investment banking are similar in many aspects, they are fundamentally totally different from each other.

A commercial bank encourages or accepts deposits from the public by various forms such as Deposits (Fixed deposits, term deposits), Savings account etc. These commercial banks are formed and regulated by “Banking Regulation act, 1949” and Reserve Bank of India guidelines. The Commercial banks operate on the principle of rotation of money, which means, money deposited by one person is lent as loan to other and interest is earned by the bank on the money lent and pays interest for the depositor. The difference between the interest earned and interest paid by the bank is the income of the bank called as Spread.

The primary function of a commercial bank is to provide financial assistance to the public in the form of loans and advances, cash credit, overdraft, bills discounting etc. whereas the primary function of an investment bank is to provide capital or financial assistance by acting as intermediary between the buyers and sellers of securities.

Investment banks cannot take deposits or lend loans like commercial bank. Investment bank can only act as intermediary for smooth transaction of buying and selling securities. Investment banks earn commission for underwriting the securities where as commercial banks earn interest on loans granted to customers.

Main functions of Investment bank are,

Issue of IPO:

Investment banks underwrite stock offerings just as they do bond offerings. In the stock offering process, companies sell a portion of the equity (or ownership) of itself to the investing public. The very first time a company chooses to sell equity, this offering of equity is transacted through a process called an initial public offering of stock (commonly known as an IPO). Through the IPO process, stock in a company is created and sold to the public. After the deal, stock sold in the India is traded on a stock exchange such as the NSE or BSE.

Hiring the Managers:

The selection criteria for hiring managers for its IPO depends on the Investment banker’s reputation and expertise as well as on the quality of research coverage in the company’s specific industry. The selection also depends on whether the issuer would like to see its securities held more by individuals or by institutional investors (i.e., the investment bank’s distribution expertise). Prior banking relationships the issuer and members of its board (especially the venture capitalists) have with specific firms in the investment banking community also influence the selection outcome. Often, the selection process is a two-way affair, with the reputable investment banker choosing its clients at least as carefully as the company should choose the investment banker.

Due diligence and Drafting:

Once managers are selected, the second phase of the process begins. For investment bankers on the deal, this phase involves understanding the company's business as well as possible scenarios (called due diligence), and then filing the legal documents as required by the SEs. Lawyers, accountants, I-bankers, and of course company management must all toil for countless hours to complete the filing in a timely manner. The Securities Act also makes it illegal to offer or sell securities to the public unless they have first been registered.

Marketing:

The third phase of an IPO is the marketing phase. Once the approval comes on the prospectus, the company embarks on a roadshow to sell the deal. A roadshow involves meeting potential institutional investors interested in buying shares in the offering. Typical road shows last from two to three weeks, and involve meeting numerous investors, who listen to the company's presentation, and then ask scrutinizing questions.

The registration and marketing process can take several months, and it is therefore impossible for the underwriter to include certain information (such as the final IPO price, the precise discount to the dealers, and the names of all the syndicate members) in its initial filing with the SEC. On the day prior to the effective date the firm and the lead underwriter finalize (and very important) details: the offer price and the exact number of shares to be sold and then the Underwriting Agreement is executed, final prospectus is printed and the underwriter files a “price amendment” on chosen effective date. Once approved, the distribution of the stock begins & the company's stock open for trade for the first time. The closing of the transaction occurs three days later, when the company delivers its stock, and the underwriter deposits the net proceeds from the IPO into the firm’s account.

The final stage of the IPO begins 25 calendar days after the IPO when the so called “quiet period” ends. This “quiet period” is mandated by the SEC, and it marks a transition from investor reliance solely on the prospectus and disclosures mandated under security laws to a more open, market environment.

Follow on offering of stock:

A company that is already publicly traded will sometimes sell stock to the public again. This type of offering is called a follow-on offering, or a secondary offering. One reason for a follow-on offering is the same as a major reason for the initial offering: a company may be growing rapidly, either by making acquisitions or by internal growth, and may simply require additional capital. Another reason that a company would issue a follow-on offering is similar to the cashing out scenario in the IPO.

Issue of Debt:

When a company requires capital, it sometimes chooses to issue public debt instead of equity. Almost always, however, a firm undergoing a public bond deal will already have stock trading in the market. (It is very rare for a private company to issue bonds before its IPO.)

Mergers & Acquisitions (M&A):

M&A advisors come directly from the corporate finance departments of investment banks. Unlike public offerings, merger transactions do not directly involve salespeople, traders or research analysts.

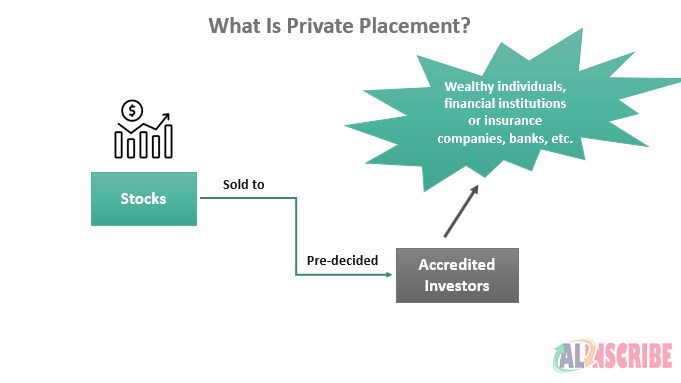

Private Placements:

A private placement, which involves the selling of debt or equity to private investors, resembles both a public offering and a merger. A private placement differs little from a public offering aside from the fact that a private placement involves a firm selling stock or equity to private investors rather than to public investors. Also, a typical private placement deal is smaller than a public transaction. Despite these differences, the primary reason for a private placement - to raise capital - is fundamentally the same as a public offering.

Financial restructurings:

When a company cannot pay its cash obligations – for example, when it cannot meet its bond payments or its payments to other creditors (such as vendors) - it goes bankrupt. In this situation, a company can, of course, choose to simply shut down operations and walk away. On the other hand, it can also restructure and remain in business.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.