THE REALITIES OF MERGERS AND ACQUISITIONS-

In today's world, individuals are always looking out for opportunities for growth and expansion of their businesses. They might want to explore and expand their market by combining or taking over their competitors. One can achieve this through Mergers and Acquisitions (M&A). So let's analyze whether this might be a great option or not.

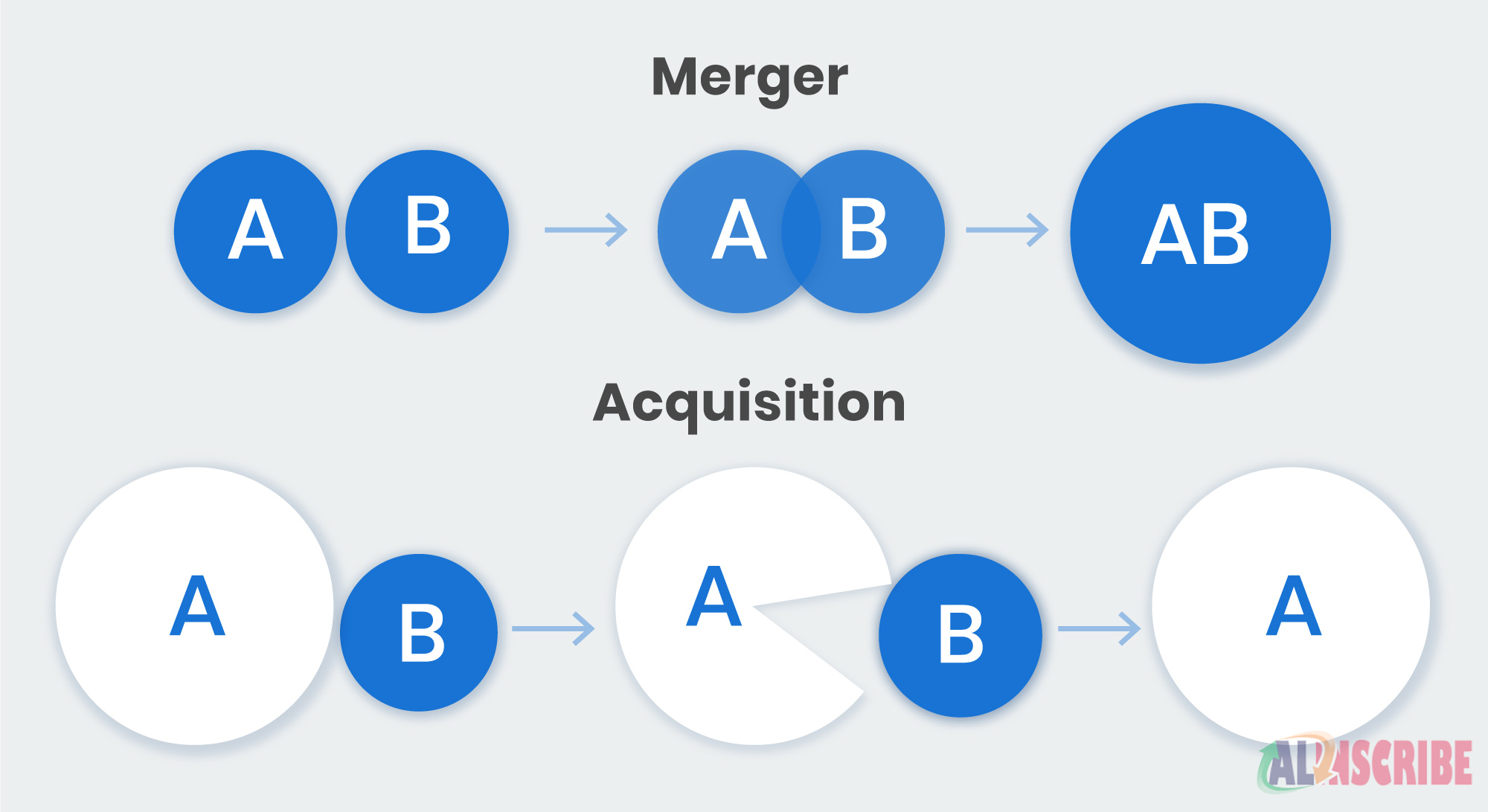

A merger is when one company combines with the other to become one larger company. There are two forms of mergers: amalgamation and absorption. When two entities combine and form a new entity, extinguishing both the existing entities it's called amalgamation. In absorption, one entity gets absorbed into another. Here, the acquiring companies take over the assets and liabilities of the company they merge with. A+B= C, where C is a new entity is an Amalgamation. A+B= A, where B is merged into a company A is Absorption.

In mergers, both companies have the best interest for each other. Here the board of directors of both the companies consent to combine and ask the approval of the stockholders of the companies. Some example of a successful merger would be companies like Dow Chemical and DuPont.

The acquisition is " a corporate action in which a company buys most, if not all, of the target company's ownership stakes to assume control of the target firm." Here one company buys another company or takes over a majority stake of the targeted firm.

There are four types of acquisition:

Friendly acquisition- Both the companies mutually agree for the takeover and there's no forceful acquisition.

Reverse acquisition- When a private company takes over a public company.

Backflip acquisition- When the purchasing company becomes a subsidiary of the purchased company.

Hostile acquisition- where the whole process is done by force and the purchasing company buys all the shares of the targeted company, hence, leaving them no choice but to surrender.

We now have an understanding of both the process in-depth, let's fathom the reason why they are accepted by so many companies worldwide.

Reasons for M&A

There are many benefits of mergers and acquisitions, the main ones include-

Synergy- It means two companies are running exceptionally well if they work together than if they operate separately. Here, the value of companies is increased. If firm A and B merge, the value of the combined firm V(AB) is expected to be greater than (VA+VB), the sum of the independent firm.

Profitability- M&A increases the companies profitability.

Larger market share- A company faces a lot of risks when it enters the market due to severe competition. However, if the competitor merges, there would be trouble-free entry and larger market shares.

New technology- All companies have to stay updated about the new technological advancements. To upgrade technology, the company can easily merge with a company having unique technology rather than acquiring new technology itself.

Tax Benefit- Mergers are also a good option to reduce tax liabilities. A high tax liability company can merge with a loss-making company to set off losses against its profits, hence having tax benefit.

After looking at the pros of M&A, let us also discuss its cons to have a better understanding of the topic.

Disadvantages:

The price paid to acquire the company- The way mergers work is to evaluate the assets of the target company and pay a price to them. It's seen that sometimes the price paid to the target company is much more than what should have been paid. While the shareholders of the target company are benefited, the shareholders of the acquiring company end up on the losing side.

- Integration difficulties- Merger is between two separate companies which may have different culture, styles of leadership and operation functions. Therefore, the merger must take into consideration the integration of the two companies so that it functions well.

- High leverage- To pay off the targeted company, the acquirer may borrow a lot from the market. This results in high leverage structure and increases the interest burden on the company.

- Conflicts between members- After the merger, it's crucial to decide the structure and composition of the boardroom and the directors. Managers or directors might lose their power and authority due to the merger. This would result in a negative environment and clashes between the members.

Now the question we all might think is whether to opt for mergers and acquisitions or not. So let's evaluate both its pros and cons.

According to researches, there are a lot of chances for the failure of Mergers and Acquisition. According to KPMG (2015), 83 per cent of the mergers did not boost shareholder returns. However, researches also show that to make it successful there should be a lot of effort and planning. Failure is the result of one's action, hence there should be enough research and study before taking any big step. Risk is present in every aspect of life but the way we deal with it differs and most importantly what actions we take is crucial.

Things to keep in mind to make Mergers and Acquisitions successful:

- Clear Vision- one needs to understand what they expect from a merger and the reason behind it. Whether it's to enter a new market, acquire new technology or expand customer base. Making a road map and the method to reach the destination might as well help. In other words, performing a feasibility study is important to conclude if the venture would be successful or not.

- Financial resources- Finance is called the lifeline of any business organisation. Thus, it's the most important factor to consider in M&A. A stable company with abundant financial resources is more likely to succeed than a company in debts. As M&A includes paying the target company it should also take care of the interest of its own company financially.

- People and culture- Human resource plays a key role in the success and longevity of every business. During M&A the company needs to incorporate styles, culture, policies and guidelines which attract other individuals. Employees of both the company should be made a part of the discussions so that there would be harmony and a peaceful working environment.

- Adjusting to changes- Changes can be related to both external and internal environment. Due to M&A, there may be drastic changes which would be needed to be implemented in the firm. Proper guidelines and decisions should be taken for the best interest of the firm.

- Patience- Having patience is most important in the process of Mergers and Acquisition as results take time to come. Here’s some data provided showing the global M&A volume and Revenue. It would give some idea.

To conclude, I would quote that "Success usually comes to those who are too busy to be looking for it." If one is determined to achieve his dreams he will pour all his heart out for it to happen. Hence, the reality of Mergers and acquisition is that it will be successful if proper research is conducted. This is a very crucial step for the whole firm and hence, needs the most attention. Risks should be identified along with the plan. One should also pay attention to the plan of all those firms which have fully benefited from this process because there is always something to learn and take back with you!

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.